By Sinéad Carew and Purvi Agarwal

(Reuters) -Wall Street’s main indexes closed lower on Tuesday as technology sector losses offset gains in communications services while investors waited for key inflation reports that may influence the Federal Reserve’s next interest rate decisions.

Among the S&P 500‘s 11 major industry sectors, only three ended with gains a day ahead of the November reading of the Consumer Price Index, one of the last major reports ahead of the Fed’s Dec. 17-18 meeting. Headline inflation is expected to have risen slightly in November to 2.7% from 2.6% in October. The Producer Price Index report will follow on Thursday.

“There’s a little bit of wait-and-see in the market ahead of the CPI and PPI data this week,” said Mona Mahajan, head of investment strategy at Edward Jones. “Markets want to see a number that won’t be too disruptive to the Fed next week.”

If the CPI comes in line with estimates, investors will expect an “all clear” for the Fed to lower rates by 25 basis points next week, she added.

Traders see an 86% chance for a cut next week, CME’s FedWatch Tool showed. Bets had jumped after Friday’s news of an uptick in unemployment along with a rebound in job growth, which had slowed in October.

Noting the S&P 500’s roughly 27% gain for the year so far, Lindsey Bell, chief strategist at 248 Ventures in Charlotte, North Carolina, said investors are cautious ahead of the economic data and Fed meeting.

“We’re in a seasonally strong period of the year and investors are just kind of taking a breather,” said Bell.

Market participants will be watching out for signs that the U.S. central bank will pause its easing cycle in January, after a host of Fed officials last week hinted at a slower pace of monetary policy easing on the back of a resilient economy.

“It’s less about what the Fed does next week but what they say about the future trajectory of interest rates,” said Bell.

The Dow Jones Industrial Average fell 154.10 points, or 0.35%, to 44,247.83. The S&P 500 lost 17.94 points, or 0.30%, at 6,034.91 and the Nasdaq Composite fell 49.45 points, or 0.25%, to 19,687.24.

Communication services, up 2.6%, was the biggest percentage gainer among S&P 500 sectors with help from a 5.6% rally in shares of Google-parent Alphabet (NASDAQ:GOOGL) after it unveiled a new chip.

The biggest percentage decliner was real estate, falling 1.6%. The S&P’s biggest index point drag was from technology, down 1.3%. It was weighed down by a 6.7% drop in Oracle (NYSE:ORCL) shares after the cloud computing company missed Wall Street estimates for second-quarter results.

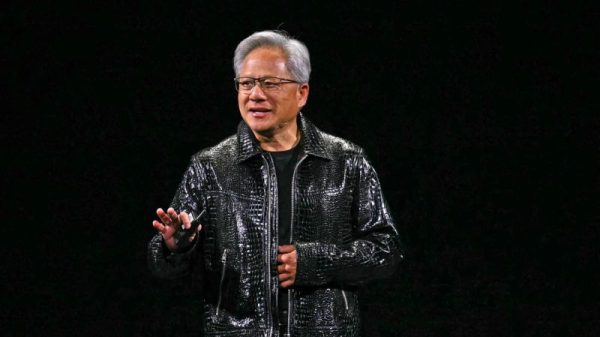

Adding pressure to technology, the Philadelphia semiconductor index fell 2.5% after China’s Monday announcement of an investigation into Nvidia (NASDAQ:NVDA) over suspected violations of anti-monopoly law. The probe was widely seen as retaliation against U.S. curbs on China’s chip sector.

Shares in Walgreens Boots Alliance (NASDAQ:WBA) rallied 17.7%, making it the S&P 500’s biggest percentage gainer after reports that it is in talks to sell itself to private equity firm Sycamore Partners.

The S&P 500’s biggest percentage decliner was Moderna Inc (BMV:MRNA), which fell 9.1% after BofA reinstated coverage of the company with an ‘underperform’ rating.

Alaska Airlines shares rose 13% after it raised its fourth-quarter profit forecast, while Boeing (NYSE:BA) gained 5.5% after Reuters reported the planemaker restarted production of its 737 MAX jets last week.

Among individual stock movers, software firm MongoDB (NASDAQ:MDB) fell 16.9% despite raising its forecast for annual results.

In mid-caps, luxury homebuilder Toll Brothers (NYSE:TOL) shares fell 6.9% after its quarterly results beat expectations but its current quarter forecasts disappointed.

Declining issues outnumbered advancers by a 1.88-to-1 ratio on the NYSE where there were 117 new highs and 42 new lows.

On the Nasdaq, 1,655 stocks rose and 2,671 fell as declining issues outnumbered advancers by a 1.61-to-1 ratio.

The Nasdaq Composite recorded 87 new highs and 86 new lows while the S&P 500 posted 10 new 52-week highs and three new lows.

On the volume side, on U.S. exchanges 13.35 billion shares change hands compared with the 14.35 billion average for the last 20 sessions.