By Valerie Volcovici

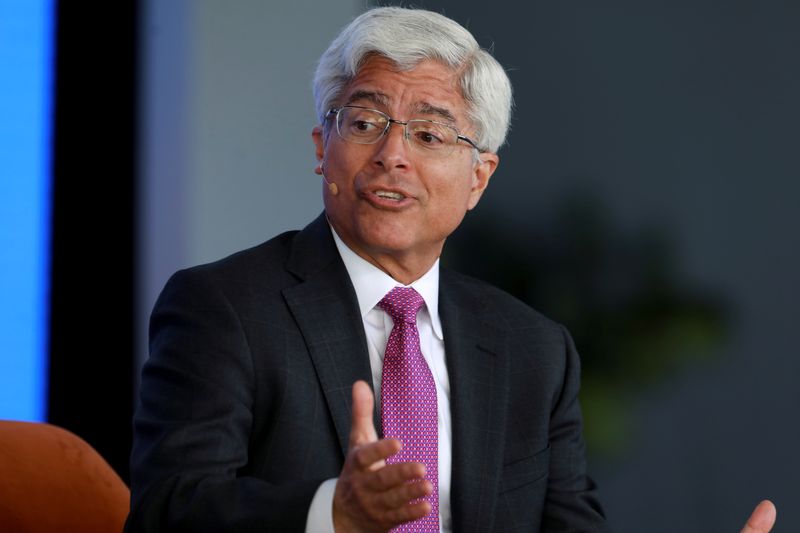

BAKU (Reuters) – The U.S. utility industry wants the incoming Trump administration and Republican-led Congress to preserve clean energy and EV tax credits in the Inflation Reduction Act, Pedro Pizarro, the CEO of utility Edison International (NYSE:EIX) said on Saturday.

The 2022 IRA contains hundreds of billions of dollars in subsidies for clean energy and is billed as outgoing President Joe Biden’s signature law to combat climate change. President-elect Donald Trump, a climate skeptic, has vowed to rescind it, something that would require support of Congress.

Pizarro, who until recently chaired the board of industry trade group Edison Electric Institute, said the lobby group’s members have been making the case with the Trump transition team and Republican members of Congress that preserving the IRA is good for businesses and consumers alike.

“One of our big priorities as an industry is going to be to articulate the benefits of the IRA,” Pizarro told Reuters on the sidelines of the COP29 climate summit in Azerbaijan. “Most of those (IRA) benefits don’t actually accrue to our shareholders. They go straight to our bills and down to our customers,” he said.

Trump’s transition team is already working on plans to kill the $7,500 consumer tax credit for electric-vehicle purchases as part of broader tax-reform legislation, Reuters has reported.

A group representing major electric vehicle and battery manufacturers including Rivian (NASDAQ:RIVN), Tesla (NASDAQ:TSLA), and Panasonic (OTC:PCRFY), on Friday also urged Trump not to kill EV tax credits, citing the impact on key states that voted Republican.

Dan Brouillette, Trump’s former energy secretary, stepped down as CEO of EEI on Oct. 28, just days before the U.S. election and is working with the transition team on energy policy and cabinet appointments.

For EEI members, which include US and international investor-owned utilities such as AES (NYSE:AES), Edison International, Duke Energy (NYSE:DUK) and Southern Company (NYSE:SO), retaining IRA tax credits for energy storage, transmission, nuclear power, hydrogen, EVs and others are crucial for continued growth, Pizarro said.

“It’s really across the board.”

EEI members will spend the coming months reaching out to members on Capitol Hill, he said.

“We’ll be very active there, just explaining the benefits of the IRA,” he said. (This story has been corrected to say ‘bills,’ not ‘builds,’ in paragraph 4)