By Dave Graham and Oliver Hirt

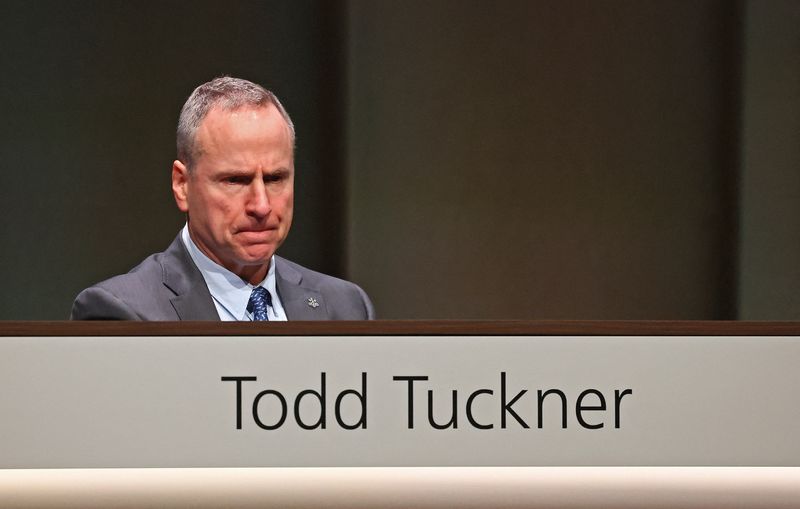

ZURICH (Reuters) – UBS has seen weak European growth hit companies it lends to, CFO Todd Tuckner said on Thursday, with the bank facing a 2024 credit loss expense of some 150 million Swiss francs ($170 million) in its personal and corporate banking business.

Tuckner’s remarks came as he explained the economic background behind the credit loss expense, which he said UBS was expecting for the fourth quarter.

“The (macro) environment in Switzerland is OK,” he said at an event in London, adding: “But some of the eurozone economies around it really have been sluggish.”

“A lot of the Swiss corporates to whom we lend have export- import businesses and they’re affected by the economies around them … if Germany is sluggish in terms of growth then it’s not unusual to see a bit higher credit loss expense.”

“It’s exacerbated a bit by the Credit Suisse dynamic,” Tuckner added, referring to the Swiss long-term rival acquired by UBS in March last year after it collapsed.

The non-core legacy unit at UBS, which is tasked with running down Credit Suisse assets, would book a pre-tax loss of $700 million in the final quarter, Tuckner said.

UBS is in the process of integrating Credit Suisse and Tuckner said the migration of clients in Singapore would take place this weekend, with Japan and Italy by the end of the year.

The CFO said he was upbeat about the bank’s Asia-Pacific business and that a positive environment there had continued into the first part of the fourth quarter. He said he was also pleased with how investment banking was doing in the quarter.

Tuckner said debate about capital requirements for banks in Switzerland is creating uncertainty for UBS and that it would likely not have clarity on the matter by early February.

Switzerland has proposed stricter rules to avoid another bank collapse, but details are still under discussion.

The government has said it will take on board the findings of a parliamentary report on the collapse of Credit Suisse due to be published in the coming weeks. Tuckner speculated that the report might not emerge until early 2025.

($1 = 0.8840 Swiss francs)