By Devayani Sathyan

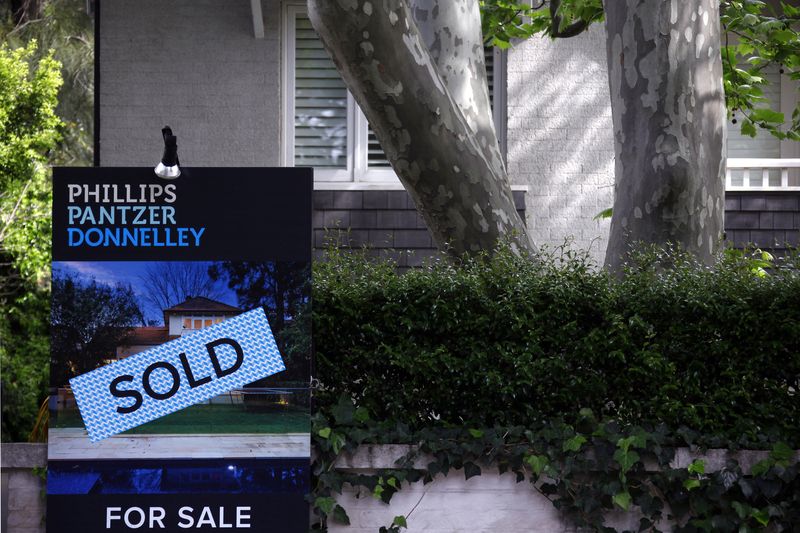

BENGALURU (Reuters) – Home prices in Australia will rise steadily over the coming two years, driven by tight supply and an expected modest easing cycle from the Reserve Bank of Australia, according to a Reuters poll.

The Nov. 12-28 Reuters survey of 12 real estate analysts forecast home prices to rise 5.0% next year and in 2026, faster than in an August poll.

Even as RBA’s interest rates climbed from 0.10% to 4.35% since May 2022, Australia’s median home prices have risen in double digits from early 2023, underscoring the property market’s resilience.

Much of that increase was due to supply shortages, an historically low jobless rate of around 4%, and immigration.

Even with borrowing costs holding near a 13-year high for over a year, home prices rose for 21 months to October, a trend seen continuing as the RBA is expected to cut rates by 75 basis points next year.

“The Australian housing market will continue to remain resilient to the various economic, interest rate, and political factors because there is a significant under-supply for a strong ongoing demand for houses to live in and to rent,” said Michael Yardney, founder of Metropole, a real estate advisory firm.

“Interest rates will fall next year and that will bring consumer confidence back and affordability to some,” Yardney said.

“First-time buyers are definitely still there in the market, but next year is going to be driven by more affluent people who have got more money with equity in their homes.”

Among major cities, house prices in Brisbane, Adelaide, and Perth were predicted to rise 5.0%, 6.0%, and 8.3%, respectively, in 2025. In Sydney and Melbourne they were forecast to rise 4.0%.

FIRST-TIME HOME BUYERS

The median asking price of homes increased from A$566,476 to A$874,827 ($368,039 to $568,375) between March 2020 and October 2024 – a 54% rise, according to data from Corelogic (NYSE:CLGX). Average wage growth has lagged substantially.

“What we have seen during this cycle in particular has been a substantial drop in borrowing capacity relative to the still solid house price growth. So that divide between people’s ability to borrow and the cost of the final home is likely to continue,” said Johnathan McMenamin at Barrenjoey.

Any relief from a rate cut from the RBA, which remains the only major central bank that has yet to lower borrowing costs, may still be several months away.

In the meantime, to address the shortage, Australian Prime Minister Anthony Albanese launched a new building programme in October and has pledged to build 1.2 million homes by 2030.

(Other stories from the Q4 global Reuters housing poll)

($1 = 1.5392 Australian dollars)