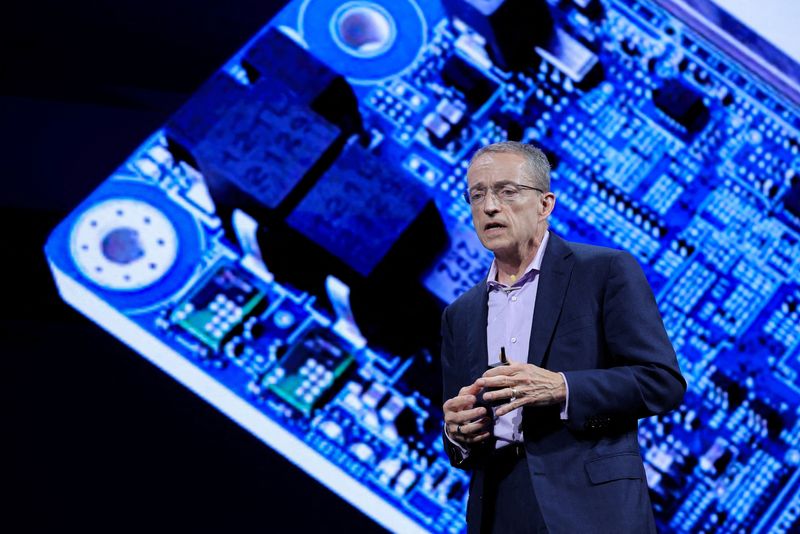

(Reuters) – Intel (NASDAQ:INTC) CEO Pat Gelsinger inherited a troubled company that had lost its edge in manufacturing skills and had ceded to rivals the hugely lucrative markets for chips used in mobile phones and artificial intelligence.

1968 – Robert Noyce and Gordon Moore found Intel, helping reshape California’s Santa Clara Valley from fruit orchards into the Silicon Valley tech hub.

1971 – Intel introduces the 4004, the world’s first commercially made programmable microprocessor, with 2,300 transistors. These were among the first chips that could be programmed to perform specific functions, unlike previous processors that were hardwired only for a certain task – a turning point in the history of the semiconductor industry that laid the groundwork for the development of CPUs.

1981 – Intel’s 8088 microprocessor, with 29,000 transistors, becomes the brain in the IBM (NYSE:IBM) Personal Computer, kicking off the era of personal computing.

1982 – Advanced Micro Devices (NASDAQ:AMD), co-founded in 1969 by a fellow Fairchild Semiconductor alum, becomes a second producer of the Intel 8086 microprocessor. This partnership would later cause a long legal battle over AMD’s rights to use Intel’s x86 chip architecture, which is the basis of a majority of PC and server chips today.

1985 – Intel decides to withdraw from the dynamic random access memory (DRAM) market – its initial claim to fame – as slumping demand prompts it to focus on microprocessors.

1985 – Intel begins cutting its workforce, impacted by an industry-wide downturn brought on by memory over-supply. Intel would lay off thousands of workers for the remainder of the 80’s.

1987 – Andy Grove, famous for his motto, “Only the paranoid survive”, becomes Intel’s third CEO and steers the company through a massive slump in the chip market. Intel solidifies its position as a linchpin of the American semiconductor industry, while players like AMD and National Semiconductor struggle.

1991 – Intel launches its “Intel Inside” marketing campaign for PCs with its chips, and the television commercials become a cultural phenomenon.

1993 – Intel introduces Pentium microprocessors, boasting 3.1 million transistors and running 300 times faster than the 8088.

1999 – Intel and Windows maker Microsoft (NASDAQ:MSFT), allies referred to as Wintel, become the first two tech companies to be added to the prestigious Dow Jones Industrial Average.

1999 – Nvidia (NASDAQ:NVDA) introduces its first graphics processing units (GPU), which during the 2000s would become an important fixture in PCs and servers with the advent of gaming and multimedia applications. Intel’s development strategy remained focused on CPUs, Reuters reported, eventually costing it a head start in the AI revolution of the 2020s.

2000 – Driven by the dot-com bubble, Intel’s stock market value reaches a record $495 billion as it, Microsoft, Cisco Systems (NASDAQ:CSCO) and Dell (NYSE:DELL) benefit from an explosion of computer sales. By late 2024, Intel’s value would fall below $100 billion.

2007 – Apple (NASDAQ:AAPL) launches the iPhone, helping kick off a mobile phone boom that Intel mostly missed. Under CEO Paul Otellini, Intel turned down a deal to make iPhone processors because it did not stand to profit enough from the arrangement. Instead, Apple used chips based on designs from Arm Holdings (NASDAQ:ARM), whose tech now dominates the mobile market.

2009 – Intel agrees to pay AMD $1.25 billion to settle decades worth of legal disputes, amid increased antitrust scrutiny over Intel’s dominance in the chip market.

2013 – Otellini steps down as CEO amid pressure from investors. Former chief operating officer Brian Krzanich becomes CEO, with a focus on diversifying the business beyond PCs to the data center market and automotive chips through acquisitions like Altera and Mobileye.

2014-16 – Under CEO Krzanich, Intel held back on using next-generation equipment used in the extreme ultraviolet lithography (EUV) technique, crucial for next-generation chips, believing it would “never work” and focusing the company’s engineers elsewhere. The fateful decision sets back Intel’s design and manufacturing businesses for roughly five years.

2016 – Intel cuts 12,000 jobs amid one of the PC industry’s worst declines in years.

2017 – Samsung (KS:005930) overtakes the U.S. company as the world’s largest chipmaker by revenue as prices soared in Samsung’s stronghold of the memory market. At the same time, Intel cedes its manufacturing technology lead to Taiwan’s TSMC, now the world’s largest contract chip manufacturer with customers including Apple.

2018 – Krzanich steps down amid mounting manufacturing setbacks. Chief Financial Officer Bob Swan becomes interim CEO.

2018 – Intel declines an offer to invest in OpenAI; CEO Swan does not believe generative AI will reach market in near future. OpenAI by 2024 has a larger market valuation than Intel.

2020 – Intel’s annual revenue peaks at $77.87 billion, bolstered by pandemic sales of PCs. Revenue then declines as Intel struggles with increased competition from AMD and Nvidia.

2020 – Nvidia’s market value overtakes Intel’s as Nvidia GPUs become the key chip for generative AI technology.

2021 – Pat Gelsinger becomes CEO, winning praise from investors who want a turnaround after manufacturing setbacks and deepening market share losses. Gelsinger focuses on transforming Intel into a producer of chips for other “fabless” firms, including his “five nodes in four years” plan that would cost billions and sap Intel’s cash flow and margins.

2021- Intel announces plans to invest $20 billion to build two manufacturing facilities in Arizona.

2022 – Intel’s market value sinks below AMD’s as the smaller chipmaker eats away at Intel’s share of the server CPU and PC chip market and becomes the most formidable challenger to Nvidia.

2024 – Intel unveils a plan to invest $100 billion across four U.S. states to build and expand factories, after securing federal grants and loans aimed at bolstering U.S. chip manufacturing.

2024 – Intel cuts 17,500 jobs, suspends dividend and embarks on a turnaround of its money-losing manufacturing business.