By Ankur Banerjee

SINGAPORE (Reuters) – Asian stocks rose on Friday, aiming to shrug off a lacklustre start to 2025, while the dollar was perched at a two-year high against a basket of currencies as investors fret about U.S. rates staying higher for longer.

MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.33% higher but on course for a nearly 1% drop for the week. The index rose nearly 8% in 2024. Japan markets are closed for the week.

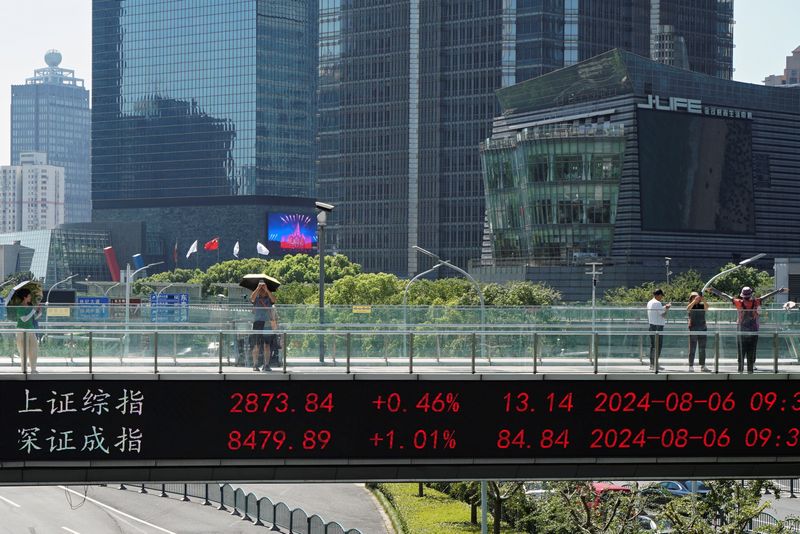

China stocks were steady on Friday after plunging on Thursday highlighting growing worries about China’s economy and a possible looming trade war when Donald Trump begins his U.S. presidency this month.

China’s blue-chip CSI 300 Index was 0.16 higher in early trading after logging its weakest New Year start since 2016 on Thursday. Hong Kong’s Hang Seng Index rose 0.19%.

“It’s been a tough period for equities around the turn of the year, but strange things can happen in illiquid markets,” said Ben Bennett, Asia-Pacific investment strategist at Legal and General Investment Management.

“I don’t think we should extrapolate this performance. That said, a stronger dollar and higher bond yields will weigh on sentiment going forward and equity investors will be hoping this changes soon.”

On Wall Street, U.S. stocks closed broadly lower on Thursday after initial gains failed to hold. Shares of Tesla (NASDAQ:TSLA) sank 6.1% after reporting its first annual drop in deliveries, [.N]

The dim mood comes in the wake of a stuttering end to 2024, denting a year-long rally fuelled by growth expectations surrounding artificial intelligence, anticipated rate cuts from the Federal Reserve, and more recently, the likelihood of deregulation policies from the incoming Trump administration.

But with the Fed last month jolting the markets by projecting fewer rate cuts than previously anticipated and rising worries that Trump’s policies may prove to be inflationary, bond yields have risen, boosting the dollar and hurting stocks.

Vasu Menon, managing director of investment strategy at OCBC, said Trump’s pro-growth and pro-business agenda may boost the US economy but for the rest of the world, it may prove challenging due to possible tariffs and a stronger dollar.

“So, there is some degree of caution and anticipation in markets especially after the strong investment performance over the past two years,” said Menon.

Data overnight showed that the number of Americans filing new applications for unemployment benefits dropped to an eight-month low of 211,000 last week, pointing to low layoffs at the end of 2024 and consistent with a healthy labour market.

That bodes well for the U.S. economy, with payrolls and inflation data later this month likely to be the focus for investors as they gauge how measured the Fed’s rate cut approach is likely to be.

Traders are pricing in 44 basis points of easing this year, below the 50 bps the U.S. central bank projected in December.

That has left the dollar index, which measures the U.S. currency against six other units, at 109.2, just below the two year high of 109.54 it touched on Thursday. The index rose 7% in 2024 as traders adjusted their interest rate expectations.

The euro was meanwhile among the biggest losers against a towering dollar, having tumbled 0.86% in the previous session to a more than two-year low of $1.022475. It was at $1.0269 in Asian hours on Friday, headed for a 1.6% weekly decline, its worst since November. [FRX/]

The yen strengthened a bit to 157.295 per dollar, but stood not too far from an over five-month low of 158.09 per dollar hit in December. The yen fell more than 10% last year, its fourth straight year of losses.

In commodities, oil prices inched higher due to optimism over China’s economy and fuel demand after a pledge by President Xi Jinping to promote growth.

Brent crude futures rose 0.16% to $76.05 a barrel, while U.S. West Texas Intermediate crude rose 0.18% to $73.25 a barrel.

Gold prices were steady at $2,658 per ounce, after a 27% rise in 2024, its strongest annual performance since 2010. [GOL/]