By Stella Qiu

SYDNEY (Reuters) – Asian shares were cautious on Wednesday as investors looked ahead to earnings results from AI darling Nvidia (NASDAQ:NVDA) where the risk of disappointment is high, while the dollar gave back a little of its recent bumper gains.

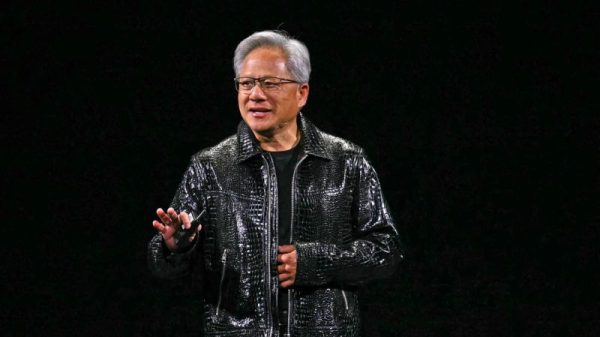

The world’s most valuable company Nvidia will report its third-quarter results after the bell. Shares already climbed 4.9% overnight and options imply a big move of almost 9% either direction in the $3.6 trillion stock often seen as a barometer for the tech sector’s shift to AI.

Nasdaq futures rose 0.2% on Wednesday on top of a 1% jump overnight. MSCI’s broadest index of Asia-Pacific shares outside Japan was flat and Tokyo’s Nikkei slipped 0.3%.

Bitcoin last held at $91,914, having broken above $94,000 for the first time overnight on expectations that U.S. President-elect Donald Trump’s administration will be crypto-friendly.

In China, the central bank held the benchmark lending rates steady as widely expected. China’s blue chips fell 0.2% while Hong Kong’s Hang Seng index edged up 0.1%.

“NVDA was naturally the key topic on everyone’s mind. Big-picture, a nice beat seems widely anticipated tomorrow,” said Joshua Meyers, executive director at JPMorgan.

“FY26 expectations have become quite ebullient, a worry that comes up increasingly in conversations … Jensen’s commentary on the call will be particularly important to level-set expectations (or not).”

Overnight, investors were rattled by Ukraine’s use of U.S. missiles to strike Russia, with Russia lowering the threshold for a possible nuclear strike, although those fears seem to have abated a little.

They are also watching the Treasury secretary pick from Trump as he assembles his governing team. CNN reported Trump can announce the decision as soon as on Wednesday.

Safe-haven currencies such as the Japanese yen and the swiss franc gained briefly, as well as Treasuries. Benchmark 10-year note yields were last up 1 bp at 4.3903%, having fallen 4 basis points, still some distance away from a five-month top of 4.505%.

The yen held at 154.96 per dollar, having hit a one-week high of 153.28 per dollar overnight. The U.S. dollar held onto the overnight losses at 106.19, off from its recent one-year top of 107.07.

Oil prices rose slightly on Wednesday, building onto the small gains overnight. U.S. West Texas Intermediate crude futures rose 0.2% to $69.53 a barrel, having ended Tuesday just 0.3% higher

Gold climbed for a third straight session, up 0.2% to $2,637.95 per ounce.