By Summer Zhen and Ankur Banerjee

HONG KONG/SINGAPORE (Reuters) – Investors are selling yen and taking shelter in cash, India, pockets of China’s markets and Singapore dollars ahead of a U.S. election that could shake out global money and trade flows.

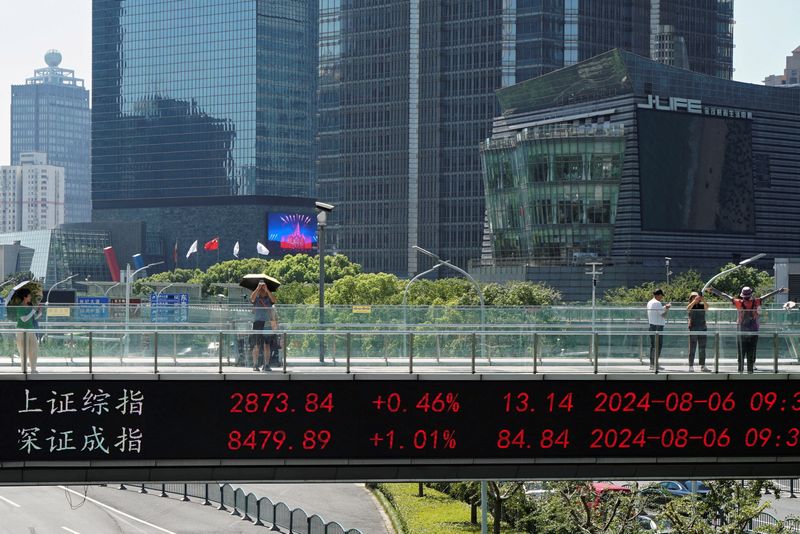

Asia’s financial markets stand on the front line of what could be a wild ride when votes are tallied and in the months ahead since the region is an export powerhouse and shares and currencies are sensitive to changes in U.S. trade policies.

That has money managers shying away from outright wagers on the outcome and looking instead to reduce exposure to vulnerabilities from Japanese manufacturers to Hong Kong stocks and make bets in India or China that stand to gain regardless of the U.S. leader.

“We actually view China as a decent place to hide,” said Jon Withaar who manages an Asia special situations hedge fund at Pictet Asset Management, since the market has a lot of domestic drivers and lower correlation with global asset moves.

“The best thing for us to do is just sit on the sidelines and wait,” he said, having already cut down on bets in Japan, where tariffs pose a risk for automakers and Hong Kong, where foreign selling of Chinese assets is likely to focus.

In the final stretch to the Nov. 5 election, betting odds have Republican Donald Trump leading Democrat Kamala Harris and financial markets have moved to sell U.S. bonds and buy dollars in anticipation a Trump administration would increase inflation.

In Asia, the low-yielding yen is favoured for selling against the dollar. Vantage Point Asset Management chief investment officer Nick Ferres is not directly trading the election but is keeping a short yen position and owns Japanese stocks.

“Our sense is that the Donald is going to win and it might even be a Republican sweep,” he said.

“The implication for the dollar is Trump is probably a bit more pro-growth…the consequence is likely higher path of rates and even more of the rate cuts that are still there for the Fed might be priced out.”

The yen’s 6.5% drop on the dollar through October is the largest fall of any G10 currency.

CLOSE CALL

Investors say they are also seeking markets least exposed to tariff risks or where other big tailwinds, from demographics to China’s promised stimulus plans, look to be blowing.

The Singapore dollar would stand tall against regional currencies, as the city-state guides the currency, said Ray Sharma-Ong, head of multi asset investment solutions for Southeast Asia at abrdn, while Indian stocks may be insulated.

“India benefits from strong domestic economic growth, low exposure to potential trade conflict due to low export-to-GDP ratio exposure and a tilt towards services exports, supported by strong earnings that are not reliant on tech,” he said.

“We also expect the equity market to prefer defensive sectors with lower exposure to exports and potential tariffs,” such as staples and utilities.”

To be sure polls show the race is too close to call and the range of outcomes, including a drawn-out or contested vote count, mean policy implications may not be immediately obvious.

“I honestly don’t know what Trump can achieve,” said John Hempton, founder and chief investment officer of hedge fund Bronte Capital in Sydney.

“If I genuinely don’t know what I’m doing, then I just try and stay out of the way – try to minimise the damage.”

Still, Goldman Sachs notes that emerging market funds have been raising exposure to China and North Asia over the past month, which could accelerate rapidly once the election passes and uncertainty hanging over investors lifts.

“We see emerging markets equities to be well placed to outperform next year regardless of the outcome,” said Gary Tan, portfolio manager, Allspring Global Investments, as China bolsters its economy and the U.S. cuts interest rates.

“We see a Harris win being marginally more positive for emerging markets.”