Investing.com — Bitcoin mining firms appear to be adopting MicroStrategy’s (NASDAQ:MSTR) Bitcoin accumulation strategy, according to JPMorgan.

The bank believes this shift is driven by challenges such as rising network hashrate, reduced mining rewards, and the introduction of spot Bitcoin exchange-traded funds (ETFs) in the United States, which have provided institutional investors with direct investment routes for Bitcoin exposure.

“Rising network hashrate and reduced mining rewards post-halving have put significant pressure on profitability with the daily revenue generation by miners on a per terahashrate basis declining further,” JPMorgan strategists said in a note.

“This likely prompted miners to hoard or seek further investments into bitcoin or diversify into AI/HPC businesses as discussed in our previous publications,” they added.

Miners like Marathon Digital Holdings Inc (NASDAQ:MARA) are increasing their Bitcoin holdings per share by issuing equity or debt.

Mara Holdings, for instance, has acquired 60% of its year-to-date Bitcoin through purchases and the rest from mining expansion, amassing near 35,000 bitcoins and becoming the second-largest publicly listed company in terms of Bitcoin holdings.

“Similar to MicroStrategy, the company has issued convertible notes at low interest rates to leverage its bitcoin purchases,” JPMorgan explains.

Instead of selling their Bitcoin reserves to cover operational costs, miners are financing their operations through debt and equity.

The total equity raised by miners year-to-date has topped $10 billion, which is more than the previous high of $9.5 billion in 2021. This approach allows Bitcoin miners to not only fund their operations “but also strengthen their market position and financial resilience,” according to strategists.

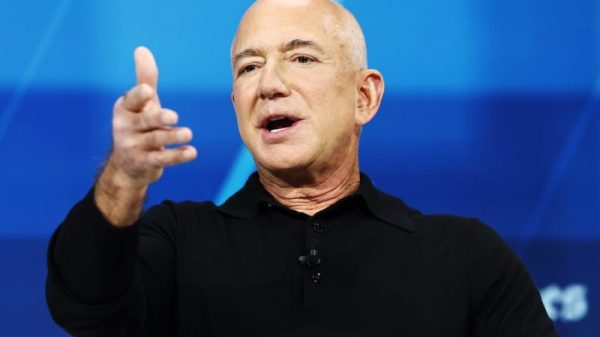

Since 2020, MicroStrategy has allocated around $25 billion toward acquiring Bitcoin, following a corporate treasury approach led by its co-founder, Michael Saylor.

This investment has generated over $17 billion in unrealized gains, based on figures from MSTR Tracker. The company’s holdings now total nearly 425,000 BTC, valued at over $42 billion.