By Eduardo Baptista

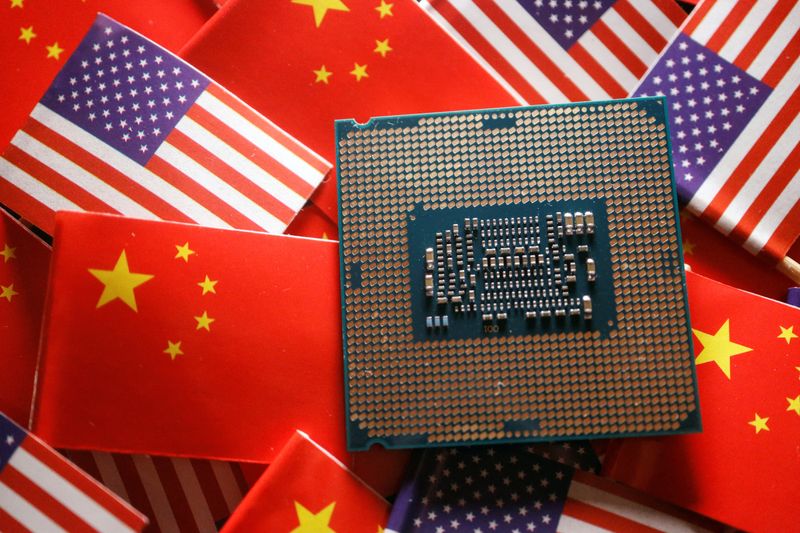

BEIJING (Reuters) – Washington’s new curbs on China’s semiconductor industry are fanning fears that Beijing could strike back, as trade tensions between the two largest economies intensify.

Chinese authorities have vowed to take action to safeguard the interests of their companies and the country has in recent years amassed a series of tools that analysts say they can use to retaliate against U.S. companies. Here are some of them:

SECURITY REVIEWS

Beijing’s announcement in May last year that it would block some government purchases from Micron (NASDAQ:MU) after the U.S. memory chip maker failed a security review is widely regarded as one of China’s first retaliatory moves in the U.S.-China chip war.

Concern has grown that U.S. tech giant Intel (NASDAQ:INTC) could be a future target, after the Cybersecurity Association of China (CSAC) alleged the American firm had “constantly harmed” the country’s national security and interests and that its products sold in China should be subject to a security review.

Intel is one of the largest providers of chips used in electronic devices including personal computers, and traditional servers in data centres in China. It received over a quarter of its total revenues from China last year.

Retaliatory action could also happen via other channels. U.S. business chambers in China have in past years complained of U.S. firms facing increased issues such as slower customs clearance and more government inspections during times of escalated tensions such as the U.S.-China trade war.

UNRELIABLE ENTITIES LIST

China in September announced that it would probe U.S. firm PVH Corp (NYSE:PVH), which owns fashion brands Tommy Hilfiger and Calvin Klein, for “unjustly boycotting” Xinjiang cotton and other products under the unreliable entity list (UEL) framework.

That was the first time Beijing had taken action against a company for removing Xinjiang cotton from its supply chain to comply with U.S. rules and one of the few times it had used the UEL since the list’s creation.

Beijing created the list during the first Trump presidency and threatened to ban U.S. companies from importing, exporting and investing in China.

To date the list has included U.S. companies involved in the sale of arms to Taiwan such as Lockheed Martin (NYSE:LMT) and RTX’s Raytheon (NYSE:RTN) Missiles & Defense.

EXPORT CONTROLS ON CRITICAL MINERALS

China dominates global mining and processing of rare earth materials and since last year has imposed rules to regulate their export.

In August, China imposed export limits on antimony, a strategic metal used in military applications such as ammunition and infrared missiles as well as in batteries and photovoltaic equipment.

China issued new curbs on some graphite products that go into electric vehicle batteries in October 2023, days after Washington banned overseas subsidiaries of Chinese companies from purchasing restricted semiconductors.

In July 2023, China announced restrictions on the export of eight gallium and six germanium products, metals widely used in chipmaking, citing national security interests.

DUAL-USE CURBS

China has recently expanded its oversight of dual-use items – products that have both civilian and military applications – with new export controls that come into effect on Dec. 1.

The new rules, first announced in September, create a unified and simplified export control list, while also requiring Chinese exporters of dual-use items to disclose details about end users. That allows Beijing to better identify supply chain dependencies on China within the U.S. military-industrial complex.

The list is expected to cover a wide range of advanced technologies where China is either leading or looking to become a leading power, including chip technology, artificial intelligence, quantum computing and drones.

Chinese sanctions on U.S. drone manufacturer Skydio this year have cut its supply of batteries, according to the Financial Times.

“As containment (of China) intensifies, more U.S. industries, businesses and the entire economy will pay an increasingly heavy price,” state-owned outlet Global Times wrote in an opinion article about Skydio earlier this month.