By Fergal Smith

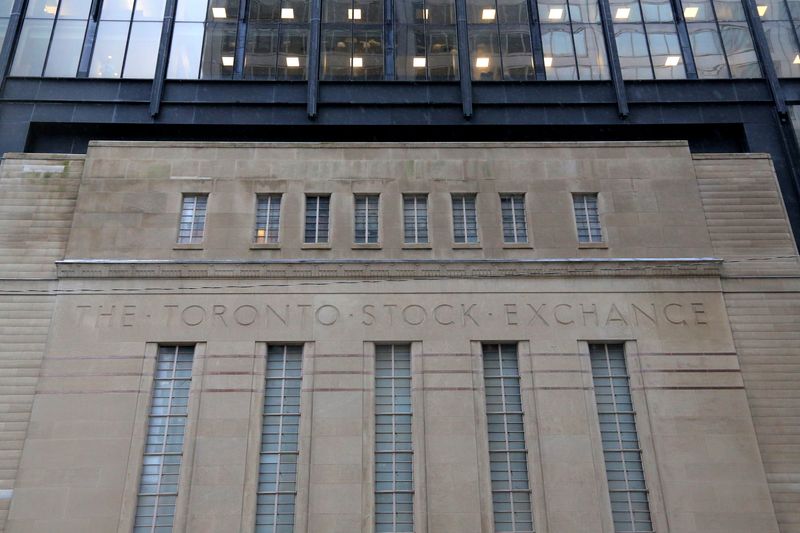

(Reuters) -Canada’s main stock index extended its record-setting run on Thursday as gains for energy shares offset a pullback in technology stocks and investors weighed recent declines for the Canadian dollar.

The S&P/TSX composite index ended up 60.65 points, or 0.2%, at 25,049.67, eclipsing the record closing high it posted on Wednesday and marking its fourth consecutive day of gains.

“The broad optimism after the U.S. election continues,” said Angelo Kourkafas, senior investment strategist at Edward Jones.

“Yes, there are some concerns about what Trump policies might mean but at the same time corporate profits are on the rise, the economy is still growing and interest rates are lower which is a really good mix for further gains.”

Ongoing economic growth, a solid job market, and inflation that remains above the 2% target mean the Federal Reserve does not need to rush to lower interest rates and can deliberate carefully, Chair Jerome Powell said.

U.S. President-elect Donald Trump has proposed sweeping tariffs that could hurt Canada’s trade-dependent economy. The Canadian dollar touched its weakest level since May 2020 at 1.4053 per U.S. dollar, or 71.16 U.S. cents.

“We have seen a significant depreciation of the Canadian dollar but relative to other currencies, it has held up pretty well,” Kourkafas said.

The energy sector rose 2.4% as the price of oil clawed back some recent declines, settling 0.4% higher at $68.70 a barrel.

Shares of Paramount Resources (OTC:PRMRF) jumped 15.3% after the company agreed to a $2.38 billion all-cash deal to sell oil assets to shale producer Ovintiv (NYSE:OVV).

The materials group, which includes fertilizer companies and metal mining shares, was up 1% and heavily weighted financials added 0.6%.

The biggest decliner was technology. It was down 3.5% after notching gains in the previous seven sessions.